How Attorneys Can Increase Conversions with Smarter Bankruptcy Lead Qualification and Intake Processes

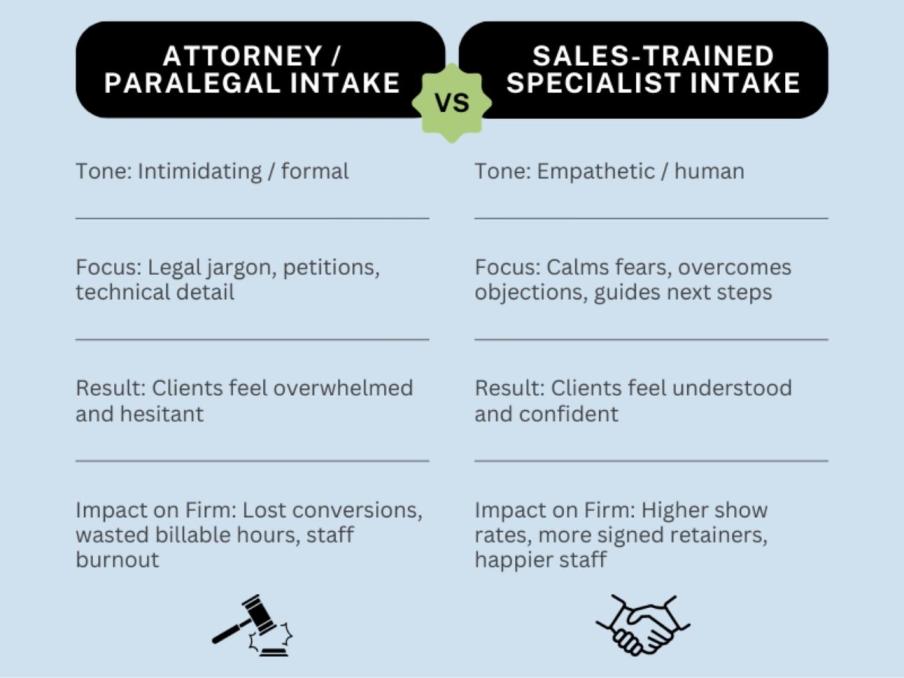

Most consumer bankruptcy attorneys treat client intake and lead qualification like it’s part of the legal work. They get on the phone themselves or hand it off to a paralegal, assuming the job is about quoting the bankruptcy code or explaining petitions.

The reality is different. Bankruptcy lead qualification is not legal work. It is sales. And when a trained non-attorney salesperson takes the first call, everything changes.

Where an attorney or paralegal can feel intimidating, a salesperson can connect on the debtor’s level. They can calm fears, handle objections, and guide leads toward the next step.

That’s when your conversion rate starts climbing. And once it picks up, it usually takes off fast. In this article, then, let’s look at how putting the right people in the right seat can boost revenue for your firm.

Why Your Time Is Wasted on Bankruptcy Lead Qualification and Intake

If you’ve run a bankruptcy practice for any length of time, you’ve probably taken calls that go nowhere.

- Maybe it’s someone making too much money to qualify, or a caller who turns out to live outside your state.

- Sometimes it’s a prospect carrying mostly non-dischargeable debt like child support or certain taxes.

- Other times, the person simply doesn’t have enough debt (or enough income) to make bankruptcy their best option.

The problem is, every one of those calls eats up valuable time. When paralegals and attorneys are the ones sorting through unqualified leads, their training and expertise get wasted on work that an intake specialist could handle.

Why Attorneys and Paralegals Shouldn’t Be in Charge of Bankruptcy Lead Qualification and Intake

Beyond that, attorneys and paralegals are not sitting in the right seat if they are engaging in lead qualification or intake. Here’s why…

Intake and lead qualification aren’t legal functions. They are sales functions.

A trained salesperson knows how to build rapport, handle objections, and move the conversation toward commitment. That’s not what attorneys went to law school for, and it’s not the best use of paralegal hours either.

When you or your paralegal are seated in the intake and lead qualification seat, here’s what happens:

- You lose clients. Successful intake requires someone trained to connect, empathize, and guide. Attorneys often slip into legal jargon that can overwhelm or intimidate debtors. Intake specialists, on the other hand, know how to calm fears, build trust, and keep people moving toward a consultation.

- You waste billable hours. Every minute that you or your paralegal spends qualifying a shaky lead is time that could have been billed. Intake doesn’t require a JD, and it pulls attorneys and paralegals away from the high-value work only they can do.

- Team morale drops. Paralegals and attorneys studied the law and strategy. They didn’t train for an intake role. When they’re stuck chasing paperwork or running through screening questions, they get frustrated. Over time, burnout rises and turnover follows.

- Opportunities slip away. A dedicated intake specialist can nurture leads who aren’t ready to file today but could be ready in a few months. Attorneys rarely have the time or bandwidth to keep those prospects engaged.

Why a Non-Attorney Salesperson Is a Better Approach for Lead Qualification

When you outsource intake or hire a non-attorney salesperson, lead qualification stops being guesswork. A trained intake specialist can follow a clear process, gather the right details, and filter out dead ends so only serious, motivated clients end up on your calendar.

Beyond that, the intake specialist can be tasked with follow-up, making sure that the leads that aren’t quite ready are nurtured until they are ready.

If you’re rethinking how your firm handles bankruptcy lead qualification and intake, check out these FAQs to help you decide what approach fits your practice best.

FAQs Table of Contents

FAQ: How can I stop wasting time on bankruptcy leads that aren’t qualified?

Answer: You can stop wasting time on unqualified bankruptcy leads by asking disqualifying questions at the beginning of your intake or consultation. Your first few questions should help you uncover information like:

- Does this client make enough money to afford bankruptcy?

- Do they have the kind of debt that qualifies for bankruptcy?

- Have they filed for bankruptcy before?

- Are they in your jurisdiction?

You can pre-qualify your clients this in-house or through an outsourced lead qualification service, such as 720 System Strategies, which uses non-attorney salespeople to qualify leads and to overcome objections.

FAQ: Should I outsource my bankruptcy lead qualification?

Answer: You should outsource if you do not have a trained salesperson in-house. Bankruptcy lead qualification should always be handled by someone trained in sales, never by an attorney or paralegal. Here’s why. Most consumer bankruptcy attorneys treat intake and lead qualification like it’s part of the legal work. They either take the calls themselves or delegate to a paralegal, thinking the job is about quoting the code or gathering case details. But that approach misses the point. Intake isn’t legal work. It’s sales work.

Think about what happens on those first calls. A debtor is nervous, embarrassed, and often convinced bankruptcy will ruin their life. If they get an attorney or paralegal on the phone, they’re likely to be hit with technical detail, legal jargon, or even skepticism about whether they should file at all. That overwhelms people and makes them less likely to move forward.

Now picture a trained salesperson in that role. They don’t try to “sound like a lawyer.” Instead, they lower defenses, calm fears, and show the debtor that bankruptcy is a tool for success, not a mark of failure. They know how to handle objections and keep the conversation moving.

When a debtor hears someone explain that they can pay $2,000 to erase $40,000 in debt, the sale almost makes itself.

That’s why having a non-attorney salesperson in this role can double or triple your conversion rate. It’s not because they know more about the law: It’s because they know less about the law and more about sales.

And in bankruptcy, the “product” is relief from crushing debt.

So if you have true sales talent in-house, put them in this role. But if you don’t have a trained salesperson on your staff, outsource to a company like 720 System Strategies.

Either way, never put your attorney or your paralegal in the lead qualification and intake seat. They’re too valuable doing legal work, and they’re simply not wired to close leads the way a trained intake specialist is.

Key takeaway: Bankruptcy lead qualification is a sales job, not a legal one. If you don’t have a trained salesperson in-house, outsource it to 720 System Strategies. Attorneys and paralegals should never be in the intake seat: You’ll get more signed clients when a sales-trained specialist handles those first calls.

FAQ: How can I get more bankruptcy leads to show up for consultations?

Answer: You’ll get more leads to show up when the first call is handled by someone trained in sales, not by an attorney or paralegal.

For most debtors, calling a bankruptcy office is one of the hardest steps they’ll ever take. They’re anxious, embarrassed, and often scared about what bankruptcy will mean for their family. If the very first voice they hear is an attorney or paralegal, the call feels formal and intimidating. That stress makes it much easier for them to cancel or disappear before the consultation.

A sales-trained intake specialist creates the opposite experience. Instead of diving into legal details, they connect with the debtor on a human level, calm their fears, and frame bankruptcy as a smart financial decision. They also know how to handle objections and secure small commitments, like placing a debit card on file, that dramatically increase show-up rates.

The result is simple: a higher show-rate for consultations, fewer wasted hours on no-shows, and more clients retained. Attorneys and paralegals should focus on the legal work. Intake belongs to someone who knows how to sell.

Key takeaway: More bankruptcy leads show up for their consultations when the intake feels safe and encouraging. A sales-trained specialist reduces fear, builds trust, and gets real commitments, something attorneys and paralegals can’t replicate from the intake seat.

FAQ: What questions should be asked during bankruptcy intake?

Answer: Bankruptcy intake should cover both the basics and the questions that move the debtor closer to filing.

Most attorneys focus only on the basics: income, dischargeable debt, prior filings, assets, tax status, and legal actions. (Long-form intake adds more detail like monthly expenses, property, and loan obligations, which gives a clearer picture.) That information is important, but it’s not enough to move a debtor forward.

When you are able to ask questions that ease fears and set up solutions, you will be more likely to convert leads into bankruptcy clients. For example:

- “Are you upside down on your vehicle? If so, we can look at options for replacing it.”

- “Would you like us to include our credit rebuilding program so you can qualify for a mortgage within two years?”

- “When would you like to get this filed? If you sign the paperwork tonight, the collections will stop this week.”

These kinds of questions not only gather facts but also show the debtor that you have a plan to help. They calm nerves, build trust, and make the consultation feel like the natural next step instead of just note-taking.

Key takeaway: The best bankruptcy intake not only collects qualifying information but also asks questions that lead to conversations that calm fears, offer solutions, and move the debtor toward filing. This combination turns a nervous caller into a committed client.

About Philip Tirone

Philip Tirone is the founder and CEO of 720 System Strategies, a marketing platform built exclusively for consumer bankruptcy attorneys. With decades of experience helping law firms attract, convert, and retain clients, Phil is known for combining advanced targeting strategies with educational follow-up systems that turn hesitant prospects into paying clients. His approach draws from thousands of campaigns nationwide, giving him deep insight into what works, and what wastes money, in bankruptcy marketing.He also shares proven tactics and case studies on his YouTube channel, 720 System Strategies, which is dedicated to helping bankruptcy attorneys grow their practices.