Summary:

- A five-minute intake is not only possible, but it often produces better results than a 30-minute call.

- Clients mainly want to know two things: Can you help them, and what will it cost? You can answer this in five minutes or less.

- Booking same-day or next-day consults dramatically increases your show rate and retention.

By Philip Tirone, founder and CEO of 720 System Strategies, with decades of experience helping bankruptcy attorneys streamline intake and convert more leads into paying clients.

Why the Five-Minute Law Firm Intake Process Works

Most attorneys treat intake like a legal interview. They ask for too many details up front, the call stretches to half an hour, and meanwhile, other calls are going unanswered. By the time you finish one intake call, you’ve missed two calls from other potential clients, and those two callers have moved onto another firm where someone answers the phone.

Jason Amerine of Castle runs about 60 filings a month, and he often knocks out intake in five minutes. Jason’s firm can handle this volume because they know what matters during an intake: Namely, clients are not looking for a law school lecture. They don’t want to hear the technical legalese of bankruptcy.

They want to feel heard. They want to understand if bankruptcy is even an option, and they want a straight answer about fees. When you meet those needs quickly and give them the next step, you stop them from calling the next attorney down the street, and you move through your consultations faster and more effectively.

In this article, we’ll take a look at what we learned from Jason.

The Five-Minute Framework

So what is the five-minute framework that Jason suggests using as a law firm intake process?

Essentially, the five-minute intake is a process for getting to the heart of the matter and letting potential clients know whether you can help them reach their goals. It cuts out all non-essential information and focuses only on what drives decisions.

“Most of my clients, all they care about is: Can I help them? And what’s it cost? And that doesn’t take a lot of questions to get to that result.”

Let’s look at the five steps of the five-minute intake.

1. Ask only what matters

The first step in the five-minute framework is to focus only on the essentials. Your intake specialist should quickly confirm the caller’s state of residence, marital status, and household size.

From there, gather housing details by asking whether they rent or own, and if it’s a mortgage, clarify the balance, value, and whether payments are current. Ask about vehicles, including the year, make, model, balance owed, payment amount, and timing of the purchase.

Round out the basics by confirming monthly gross income for the debtor (and spouse if married), total unsecured debt, and whether they have filed for bankruptcy within the last eight years.

These questions provide all the information needed to decide next steps without wasting time.

2. Explain the path and the price

Once the essentials are clear, the intake specialist can identify whether the case is likely a Chapter 7 or Chapter 13 at a high level. This isn’t the time for detailed legal analysis. Instead, share the expected chapter and give the fee or a clear range in plain, everyday language. Avoid legal jargon or drawn-out explanations.

Prospects want to know the answer to two questions immediately:

- “Can you help?”

- “What will it cost?”

Clear and direct answers position the firm as confident, efficient, and trustworthy.

3. Book the appointment immediately

Once the chapter and fee are explained, the next move is to secure the appointment right away. Always offer the soonest available slot, ideally the same day or the next. Pushing the consultation out five days or more significantly lowers the show rate.

Debtors who gather the courage to make that first call are ready to act, and the momentum should not be lost. A strong intake process locks in their commitment while they’re motivated, reducing the risk of them calling another firm.

4. Remove judgment

Throughout the call, the intake specialist must communicate without judgment. Normalize the situation by explaining that most bankruptcies result from divorce or medical events, such as life circumstances that no one plans for. When callers realize they aren’t being judged, their defenses drop, and they are far more likely to trust the process. This simple shift in tone helps clients feel safe, understood, and open to moving forward with the consultation.

5. Follow up until retained

Not every caller will be ready to retain the same day, and that’s where follow-up becomes critical.

- If someone says they can move forward on payday, make a note and schedule the follow-up immediately.

- Use friendly reminders by phone, text, or email to stay connected and keep the pipeline warm.

- To make this easier, you can plug callers directly into the 720 System Strategies automated lead follow-up system for bankruptcy attorneys, which keeps prospects engaged for months (and even years) with texts, emails, and reminders until they are ready to sign.

Consistent follow-up bridges the gap between interest and commitment, ensuring fewer leads fall through the cracks and more prospects ultimately become clients.

Watch & Learn: A Case Study in Onboarding Clients in Five Minutes

Why Speed Beats Sympathy on the First Call

Some attorneys and intake specialists let intake turn into a counseling session. They let callers vent, share every detail, and by the time the call ends, no appointment is booked. Remember: Sympathy is important, but the goal of the first intake is to qualify, quote, and book the consultation. Longer conversations and emotional storytelling come later, after the client has retained the attorney.

Frequently Asked Questions (FAQs)

- Should I handle intake calls myself, or should I hire someone else?

- What questions should I ask during the first bankruptcy intake call?

- How soon should I schedule the consultation after intake?

- What is the best way to follow up with people who are not ready to file bankruptcy?

FAQ: Should I handle intake calls myself, or should I hire someone else?

Answer: It depends on whether you are comfortable in sales. Jason believes the attorney should run intake, and when he does, he acknowledges the client’s situation, makes clear he isn’t judging, and then keeps the conversation moving toward a decision. His view is that when the client hears directly from the attorney, the client is more likely to trust that the firm can handle the case.

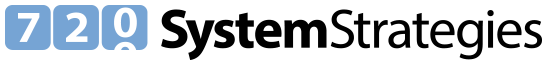

At 720 System Strategies, we often recommend a slightly revised model: Let a trained non-attorney salesperson handle intake, unless the attorney is trained in sales. Our position is this: Intake is fundamentally a sales role, not a legal one. Since sales specialists tend to be less intimidating, they are often better equipped to calm fears, and skilled at overcoming objections so prospects stay engaged and book quickly.

Both approaches can work, depending on the firm. If an attorney is comfortable guiding conversations and strong at building rapport fast, having them lead intake may fit. If not, intake is usually better left to a dedicated specialist.

FAQ: What questions should I ask during the first bankruptcy intake call?

Answer: You only need a handful of details to decide next steps. These include:

- State of residence

- Marital status and household size

- Housing (rent or mortgage, and if mortgage: balance, value, and payment status)

- Vehicles (year, make, model, balance, payment, timing)

- Monthly gross income for debtor and spouse if married

- Total unsecured debt

- Prior bankruptcies within the past eight years

Asking anything beyond those questions risks dragging the call out and losing momentum.

FAQ: How soon should I schedule the consultation after intake?

Answer: Schedule the consult as soon as possible: Ideally same-day or next-day. When we provide lead qualification services for bankruptcy attorneys, we make live transfers so the attorneys can conduct the consultation as soon as the debtor has been pre-qualified.

Debtors are motivated when they first call. If you push them out five days, your show rate drops. A quick booking keeps them from calling the next attorney on the list.

FAQ: What is the best way to follow up with people who are not ready to file bankruptcy?

Answer: The most effective follow-up combines automation with personal touch.

- Add the lead to an automated email or text campaign so no prospect slips through the cracks.

- Schedule personal phone calls based on what the lead tells you during intake. For example, if they mention payday or a specific timeline, tie your reminder to that date.

This approach keeps you top of mind without overwhelming the prospect. To make it even easier, you can plug leads into the 720 System Strategies four-year automated follow-up system, which uses consistent texts and emails to keep prospects engaged until they’re ready to move forward.

About Philip Tirone

Philip Tirone is the founder and CEO of 720 System Strategies, a marketing platform built exclusively for consumer bankruptcy attorneys. With decades of experience helping law firms attract, convert, and retain clients, Phil is known for combining advanced targeting strategies with educational follow-up systems that turn hesitant prospects into paying clients. His approach draws from thousands of campaigns nationwide, giving him deep insight into what works, and what wastes money, in bankruptcy marketing.He also shares proven tactics and case studies on his YouTube channel, 720 System Strategies, which is dedicated to helping bankruptcy attorneys grow their practices.